Brickie Leaks: Uncovering the Hidden Stories

Dive into a world of revealing news and insights.

From Blockchain to Bank: The Ins and Outs of Digital Collectibles

Explore the fascinating world of digital collectibles! Discover how blockchain is revolutionizing the art of collecting and transforming banking.

Understanding Digital Collectibles: What They Are and How They Work

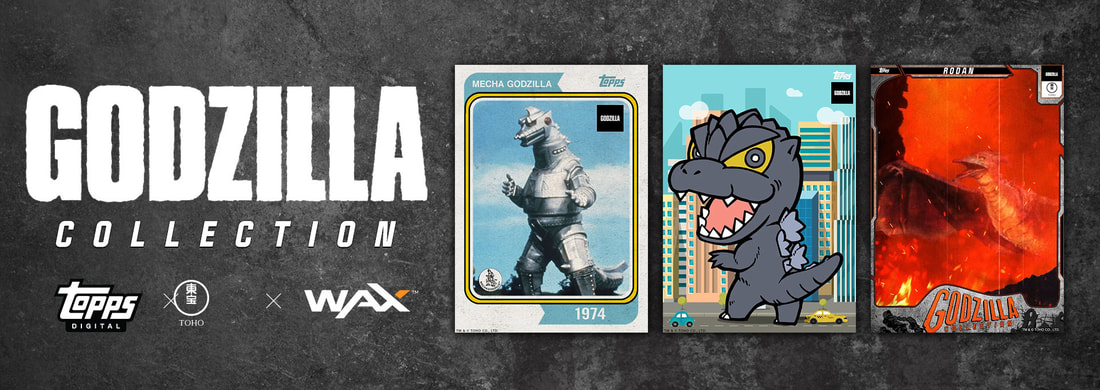

Digital collectibles are unique digital assets that are often based on blockchain technology, allowing them to be securely owned, traded, and verified. Unlike physical collectibles, digital items such as virtual trading cards, art pieces, and in-game goods derive their value from scarcity, provenance, and demand. Created as non-fungible tokens (NFTs), each digital collectible has a distinct value and cannot be exchanged one-for-one like traditional currencies. With platforms like Ethereum and Binance Smart Chain facilitating the creation and exchange of these assets, digital collectibles are reshaping how we perceive ownership in the digital age.

Understanding how digital collectibles work involves grasping the concept of blockchain technology and the role of NFTs. Each digital collectible is recorded on a decentralized ledger, ensuring transparency and security. Owners can buy, sell, or trade their assets through various online marketplaces. Additionally, factors such as rarity, creator reputation, and market trends can significantly influence the value of these collectibles. As the interest in digital assets grows, collectors and investors alike are increasingly exploring the potential of this innovative form of ownership, marking the dawn of a new era in the collectibles market.

Counter-Strike is a highly popular team-based first-person shooter that has captivated players since its original release. With its strategic gameplay and competitive scene, many gamers are always on the lookout for ways to enhance their experience. One way to do this is by using a daddyskins promo code to acquire unique skins and items.

The Journey of Digital Assets: From Blockchain to Bank

The journey of digital assets has transformed remarkably since the advent of blockchain technology. Initially developed as the underlying framework for cryptocurrencies, blockchain has evolved into a secure and decentralized method for recording transactions. This innovation has not only revolutionized how we perceive ownership but has also paved the way for various digital assets, including non-fungible tokens (NFTs) and stablecoins. As more industries adopt blockchain technology, they are discovering its potential to enhance transparency, reduce fraud, and streamline processes.

As the use of digital assets has grown, traditional financial institutions have begun to take notice, leading to a merging journey from blockchain to the bank. Many banks are now exploring how to integrate blockchain into their existing systems to improve efficiency and security. This integration signifies a shift in the financial landscape, where digital assets can be seamlessly transferred, stored, and managed alongside conventional assets. In this evolving environment, consumers can expect a new era of financial services that leverage the strengths of both the digital and traditional worlds.

Are Digital Collectibles the Future of Investing?

As the digital landscape continues to evolve, digital collectibles have emerged as a revolutionary asset class that could redefine the future of investing. These unique digital items, often represented by non-fungible tokens (NFTs), have gained traction among collectors and investors alike. With the ability to verify ownership and provenance through blockchain technology, digital collectibles offer a level of authenticity that traditional investing methods struggle to provide. As more individuals recognize their value, we may witness a significant shift in investment strategies, with digital collectibles taking center stage.

Moreover, the demographic trends suggest that younger generations are increasingly drawn to digital collectibles. This shift is driven by their familiarity with technology and digital assets, making them more likely to invest in items that are not confined to the physical realm. Digital collectibles provide an engaging and interactive experience, making them appealing for investment. As platforms for buying, selling, and trading these assets continue to evolve, investors must keep an eye on this burgeoning market and consider how it can fit into a diversified investment portfolio.