BrickieLeaks: Uncovering the Truth Behind the Headlines

Explore the latest news, insights, and stories that matter.

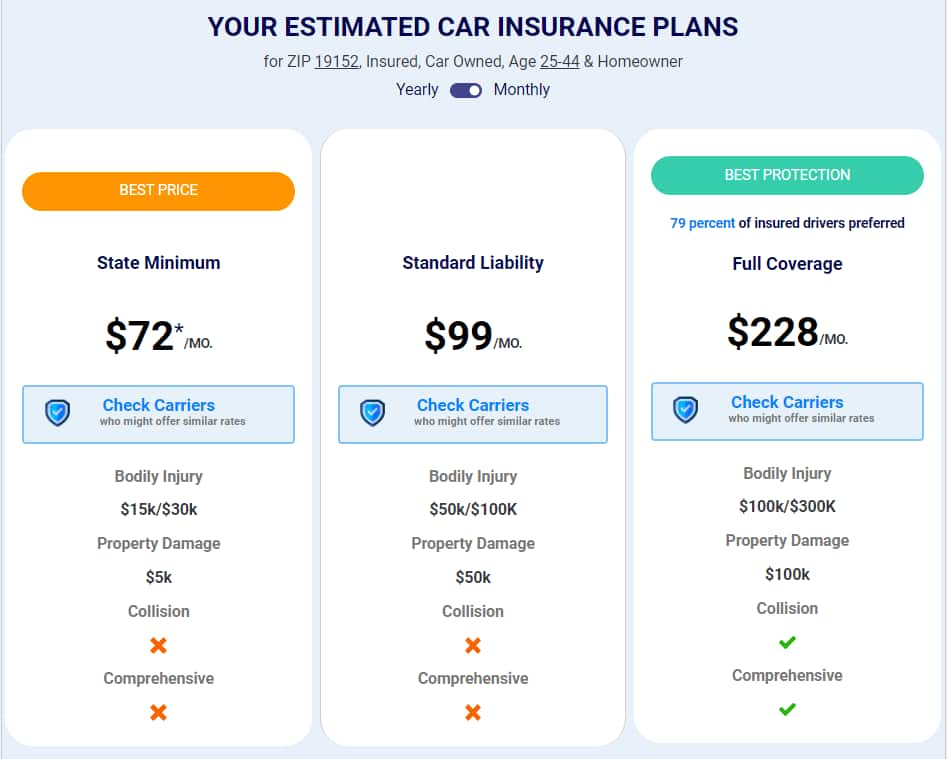

Insurance That Doesn’t Break the Bank

Discover affordable insurance tips that keep you covered without draining your wallet. Unlock savings today!

5 Tips for Finding Affordable Insurance Without Sacrificing Coverage

Finding affordable insurance that doesn't compromise on coverage can often feel like searching for a needle in a haystack. However, by implementing a few smart strategies, you can secure the protection you need without breaking the bank. Start by shopping around and comparing quotes from multiple providers, as rates can vary significantly. Utilize online comparison tools to streamline this process and ensure you are aware of all available options. Consider bundling your policies—for instance, combining auto and home insurance can lead to substantial discounts.

Another effective strategy is to review your coverage needs. Assess your current policies and eliminate any unnecessary extras that may inflate your premium. Additionally, maintain a good credit score, as many insurers factor this into their pricing models. When possible, raise your deductibles. A higher deductible often results in lower monthly premiums, allowing you to save on insurance without sacrificing the essential coverage. By being proactive and informed, you can find affordable insurance that meets your needs without compromising on quality.

Is Cheap Insurance Too Good to Be True? What You Need to Know

When it comes to insurance, the phrase cheap insurance often sparks curiosity and skepticism. While the allure of low premiums can be enticing, it’s essential to analyze what you might be sacrificing for these savings. Many budget-friendly policies come with limited coverage, higher deductibles, and exclusions that can leave you vulnerable in times of need. Therefore, before you jump at the first inexpensive option, consider performing a thorough evaluation of policy details and comparing multiple providers.

One critical aspect to understand is that cheap insurance can sometimes indicate lower-quality service or a lack of comprehensive support. If you find yourself weighing budget over benefits, take a moment to reflect on the potential costs of being underinsured. In the long run, it may be wiser to invest a little more for peace of mind. Always remember, finding the right balance between affordability and adequate coverage is key to safeguarding your assets and ensuring peace of mind.

Understanding the Hidden Costs of Insurance: How to Save Money

When it comes to insurance, many people focus solely on the premiums they pay, overlooking the hidden costs that can significantly impact their overall expenses. These costs include deductibles, co-pays, and out-of-pocket maximums, all of which can vary widely among different policies. Additionally, there may be fees associated with policy changes or cancellations that could catch policyholders off guard. It is crucial to read the fine print and understand all terms before committing to an insurance plan to avoid these surprise costs.

To effectively save money on insurance, consider the following strategies:

- Shop around for different providers to compare quotes and coverage options.

- Increase your deductible, which can lower your monthly premium but requires careful consideration of potential out-of-pocket expenses.

- Utilize discounts offered by insurers, such as bundling policies (e.g., home and auto) or maintaining a good driving record.