Brickie Leaks: Uncovering the Hidden Stories

Dive into a world of revealing news and insights.

Save Big on Your Ride: Discover Hidden Auto Insurance Discounts

Unlock secret auto insurance discounts and save big on your ride! Discover tips that can boost your savings today!

Unlocking Savings: A Guide to Auto Insurance Discounts You Didn't Know Existed

Finding ways to save on auto insurance can feel like a daunting task, but there are numerous auto insurance discounts that many drivers overlook. One of the most common yet underutilized discounts is the multi-policy discount, which allows you to bundle your auto insurance with other policies, such as home or renter's insurance. Additionally, some insurers offer discounts for good driving records, so maintaining a clean driving history can have significant financial benefits.

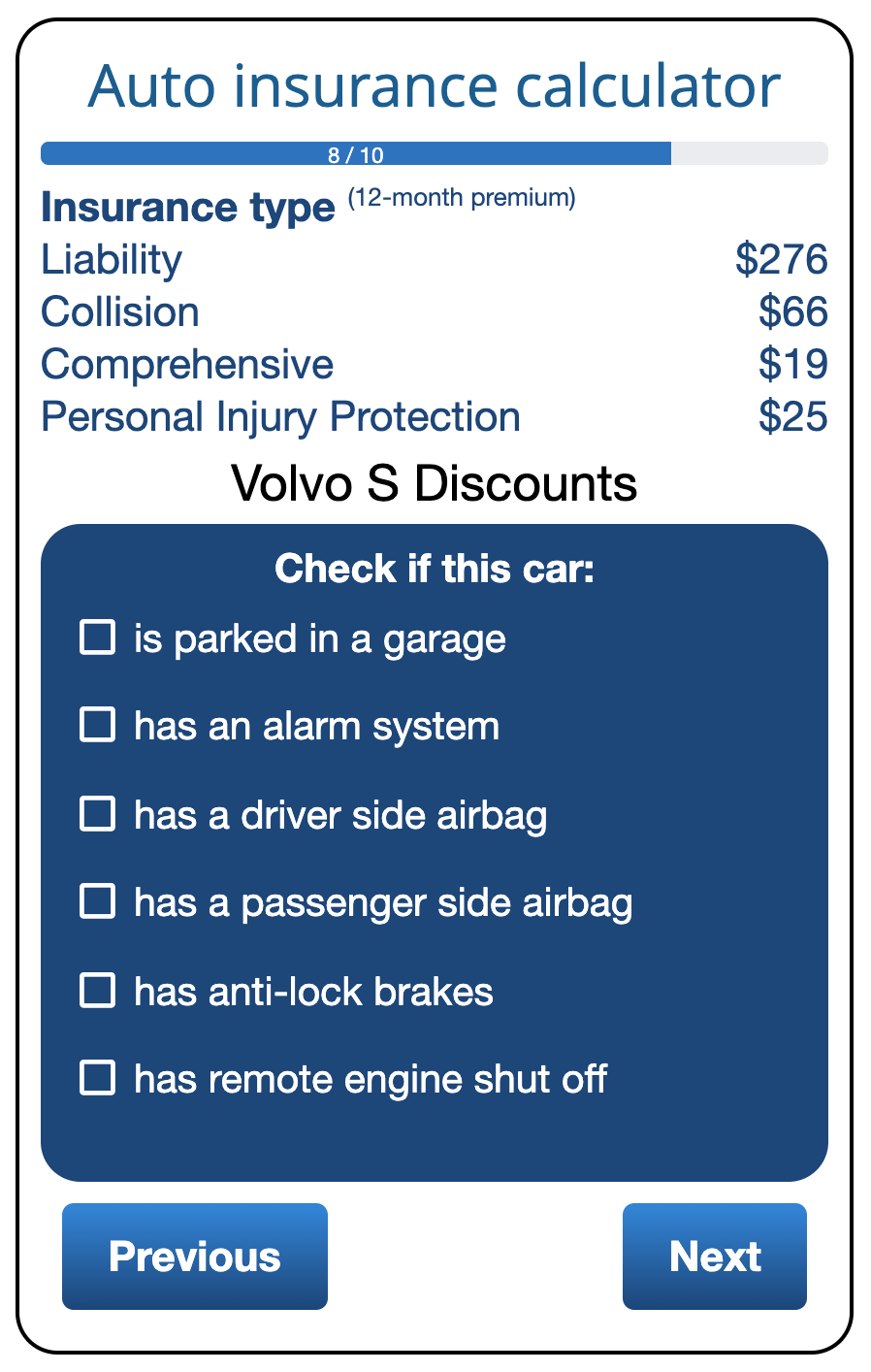

Moreover, many auto insurers provide discounts for defensive driving courses. Completing an accredited course not only enhances your skills on the road but can also lead to substantial savings on your premium. Other discounts to explore include those for low mileage, being a member of certain professional organizations, and even having certain safety features installed in your vehicle. By taking the time to research these lesser-known options, you can unlock valuable savings on your car insurance.

Are You Missing Out? 7 Common Auto Insurance Discounts You Could Be Claiming

Many car owners are unaware that they could be saving money on their premiums through various discounts offered by auto insurance companies. Auto insurance discounts can significantly reduce your overall costs, making it essential to investigate what perks you may be eligible for. Below are some common discounts you might be missing out on:

- Multi-Policy Discount: Bundling your auto insurance with other policies, such as home or renters insurance, often leads to substantial savings.

- Safe Driver Discount: Maintaining a clean driving record can qualify you for discounts that reward safe driving habits.

- Good Student Discount: Students who excel academically can take advantage of discounts by proving their scholastic achievements.

- Low Mileage Discount: If you drive less than the average mileage, your insurer might offer a discount as a reward for less exposure to risk.

- Anti-Theft Device Discount: Installing a refrigerator or motion sensor system can lead to reductions in your insurance costs.

- Military or Professional Discounts: Certain professions or military service members may be eligible for exclusive discounts.

- Renewal Discount: Staying with the same insurance company for a number of years can sometimes lead to loyalty discounts.

How to Navigate the World of Auto Insurance: Tips for Finding the Best Discounts

Navigating the world of auto insurance can be overwhelming, especially when you're trying to find the best discounts available. Start by understanding your specific needs: consider factors such as your driving habits, the type of vehicle you own, and your budget. Research a variety of insurance providers, as each company offers different rates and discounts. Make a list of potential insurers and their offerings, paying close attention to customer reviews and their claim processes. This careful groundwork can drastically improve your chances of finding a policy that provides both adequate coverage and significant savings.

Once you've narrowed down your options, utilize a few strategies to unlock discounts. For instance, inquire about multi-policy discounts if you have home or renter's insurance; bundling policies often results in lower overall premiums. Additionally, maintaining a clean driving record and completing defensive driving courses can earn you further reductions. Don't hesitate to ask your insurer directly about any available discounts, as they may not always advertise them openly. By actively engaging with your insurance provider and exploring all possible avenues, you can ensure that you're getting the best value for your auto insurance coverage.